does south dakota have sales tax on vehicles

How much is sales tax on a vehicle in South Dakota. At a total sales tax rate of 6500 the total cost is 37275 2275 sales tax.

Sales Tax On Cars And Vehicles In South Dakota

The car dealer will follow the sales tax collection laws of their own state.

. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. South Dakotas sales tax rates for commonly exempted items are as follows. While South Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. 0 through 9 years old. Sales Tax Exemptions in South Dakota.

What rates may municipalities impose. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1814 for a total of 6314 when combined with the state sales tax. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. When this happens all citizens of South Dakota suffer.

When calculating the sales tax for this purchase Steve applies the 4000 state tax rate for South Dakota plus 2500 for Aberdeens city tax rate. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

The cost of a vehicle inspectionemissions test. The state sales tax rate in South Dakota is 4500. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens.

You can find these fees further down on the page. For instance they have no state income tax very low sales tax and due to a number of mail forwarding services it is easy to establish residency in south dakota. The South Dakota Department of Revenue administers these taxes.

A customer living in Aberdeen finds Steves eBay page and purchases a 350 pair of headphones. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. There are two types of claims that can be made following a total loss accident both are covered in this chart.

Only some sd counties mandate the. Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. Additionally if you want to avoid surprise maintenance costs after buying a used car you should think about ordering a vehicle.

Motorcycles under 350 CC. Some other states offer the opportunity to buy a vehicle without paying sales tax. This page discusses various sales tax exemptions in South Dakota.

This chart covers payment of sales tax after vehicle total loss. State sales tax of 4225 percent plus your local sales tax Document on the purchase price less trade-in allowance if any. The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2.

Click to Download Chart. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any. Select the South Dakota city from the list of popular cities below to see its current sales tax rate.

Washington DC the nations capital does not charge sales tax on cars either. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The remaining states have the highest sales tax all 7 or above.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. The South Dakota DMV registration fees youll owe. Registration license plate fees based on either taxable horsepower or vehicle weight.

Sales Use Tax. Motor vehicles are not subject to the motor vehicle excise tax if. How do I pay sales tax on a car.

For vehicles that are being rented or leased see see taxation of leases and rentals. The excise tax which you pay on vehicles in south dakota is only 4. The SD sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

That way you dont have to deal with the fuss of trying to follow each states. Municipalities may impose a general municipal sales tax rate of up to 2. This means that an individual in the.

10 years old or older. Applicable municipal sales tax municipal gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. This includes the following see.

What states have the highest sales tax on new cars. Parameter must be an array or an object that implements Countable in home. The purchaser requests and is approved for a title only included in SDCL 32-3-4.

First-party claims and third-party claims. State sales tax and any local taxes that may apply. South Dakota levies a state sales tax of 4 percent on the purchase of all motor vehicles in the state.

States with High Sales Tax. The cost of your car insurance policy. To learn more see a full list of taxable and tax-exempt items in South Dakota.

South Dakota - 4. Motor vehicles exempt from the motor vehicle excise tax under. SDL 32-5-2 are also exempt from sales tax.

Fees to Register a Car in SD. This page describes the taxability of leases and rentals in South Dakota including motor vehicles and tangible media property. Also to know is what is South Dakota sales tax.

The excise tax which you pay on vehicles in south dakota is only 4. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. With local taxes the total sales tax rate is between 4500 and 7500.

The high sales tax states are. Services as well as physical goods make up a significant portion of gross sales and transactions. Buy a car in Maryland North Carolina Iowa or South Dakota and you might be able to skip the cost of sales tax on your Ford Chevy or Subaru.

This way you dont have to. Any titling transfer fees. South Dakota has recent rate changes Thu Jul 01 2021.

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. Non-commercial vehicles weighing up to 4 tons. The 2012 South Dakota Legislature recognizing the fact that all businesses should pay their fair share of taxes approved House Bill 1029 which allows the Department of Revenue to publicly list persons who are delinquent in paying sales tax use tax tourism tax municipal tax municipal.

Registration fees in South Dakota are based on the type age and weight of the vehicle.

Essential Guide On How To Establish South Dakota Domicile

Cars Trucks Vans South Dakota Department Of Revenue

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident

Dealer Requirements License Plates South Dakota Department Of Revenue

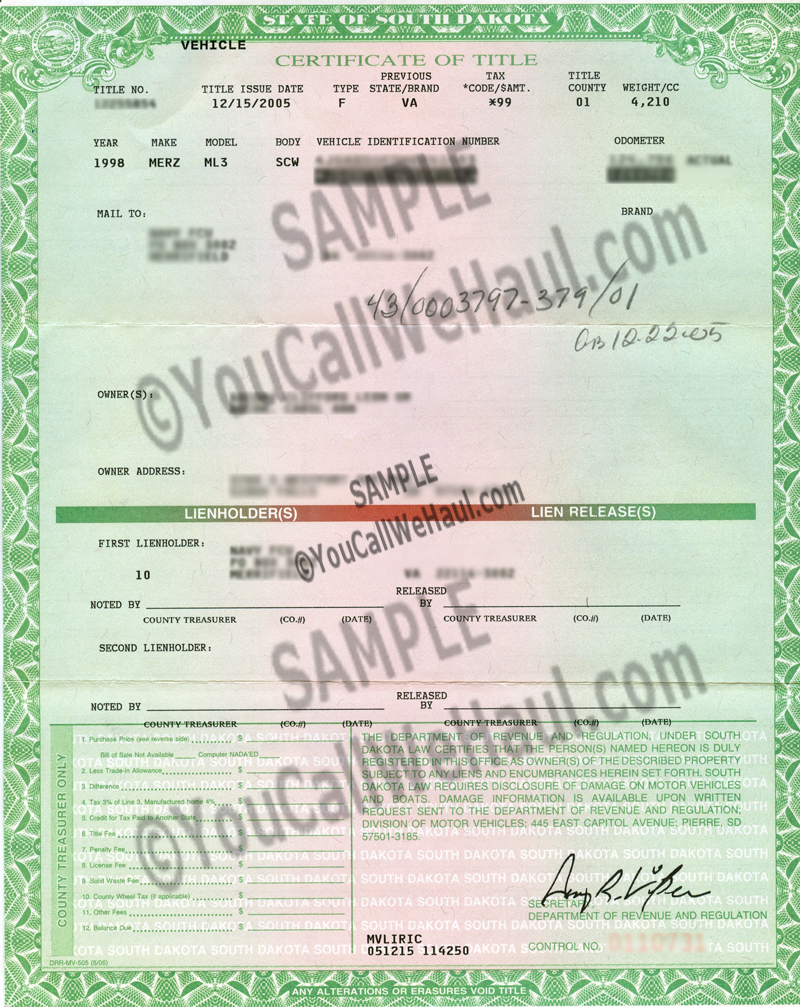

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

South Dakota Vehicle Title Donation Questions

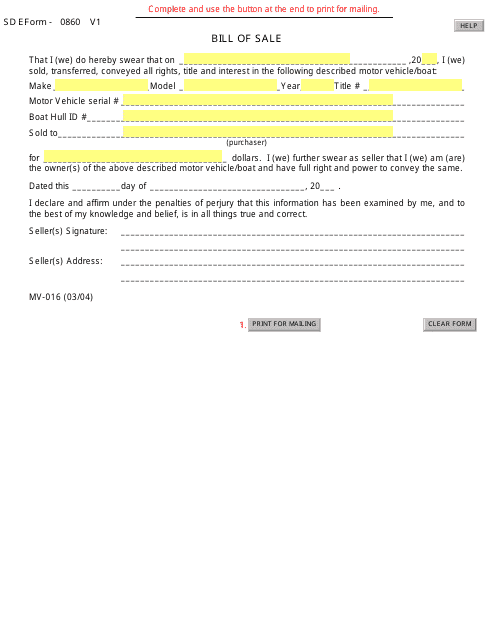

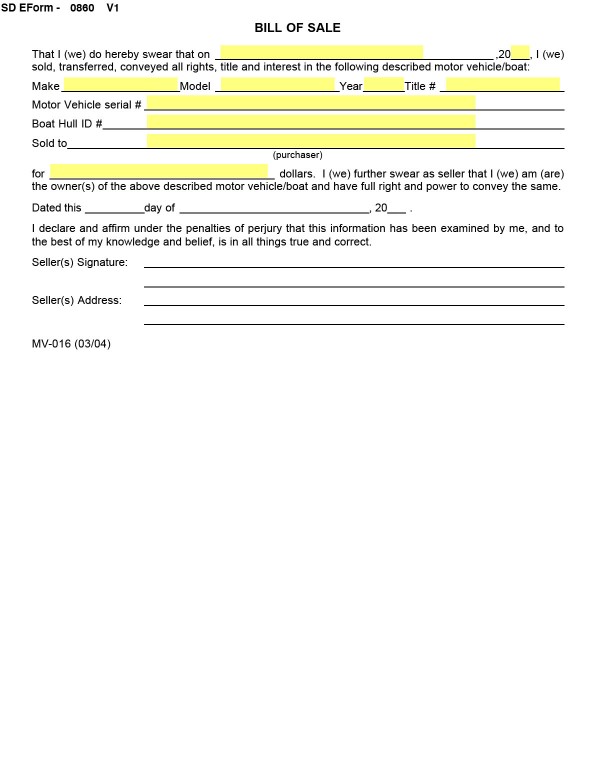

Form Mv 016 Sd Form 0860 V1 Download Fillable Pdf Or Fill Online Bill Of Sale For Motor Vehicle Boat South Dakota Templateroller

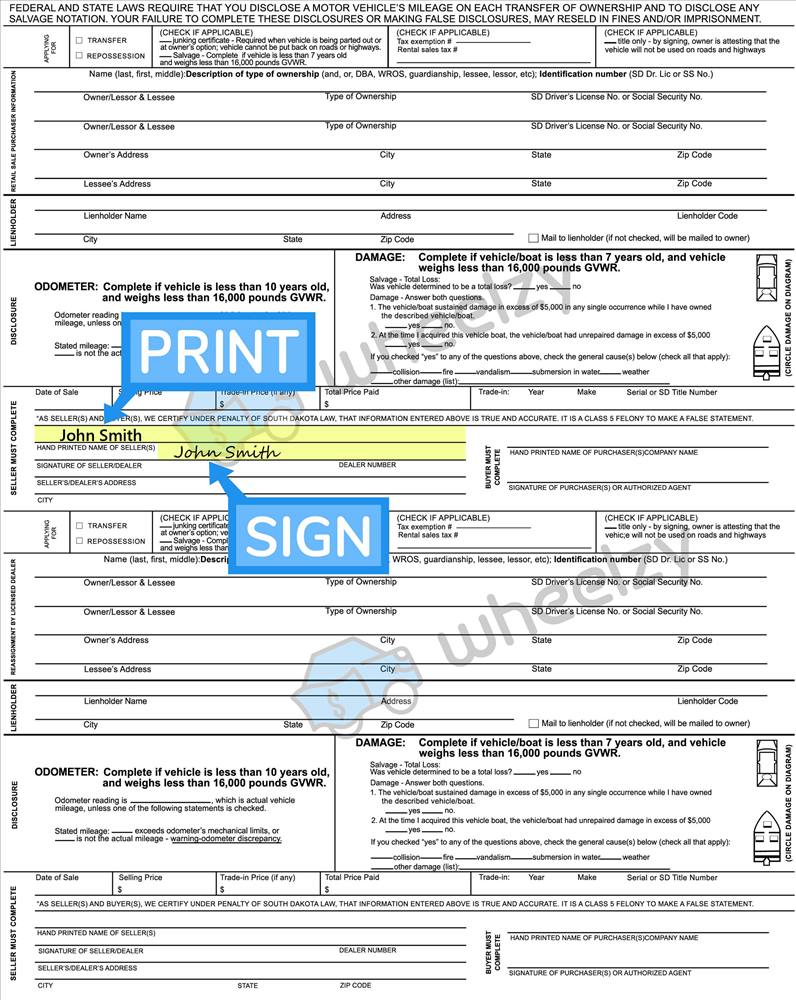

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

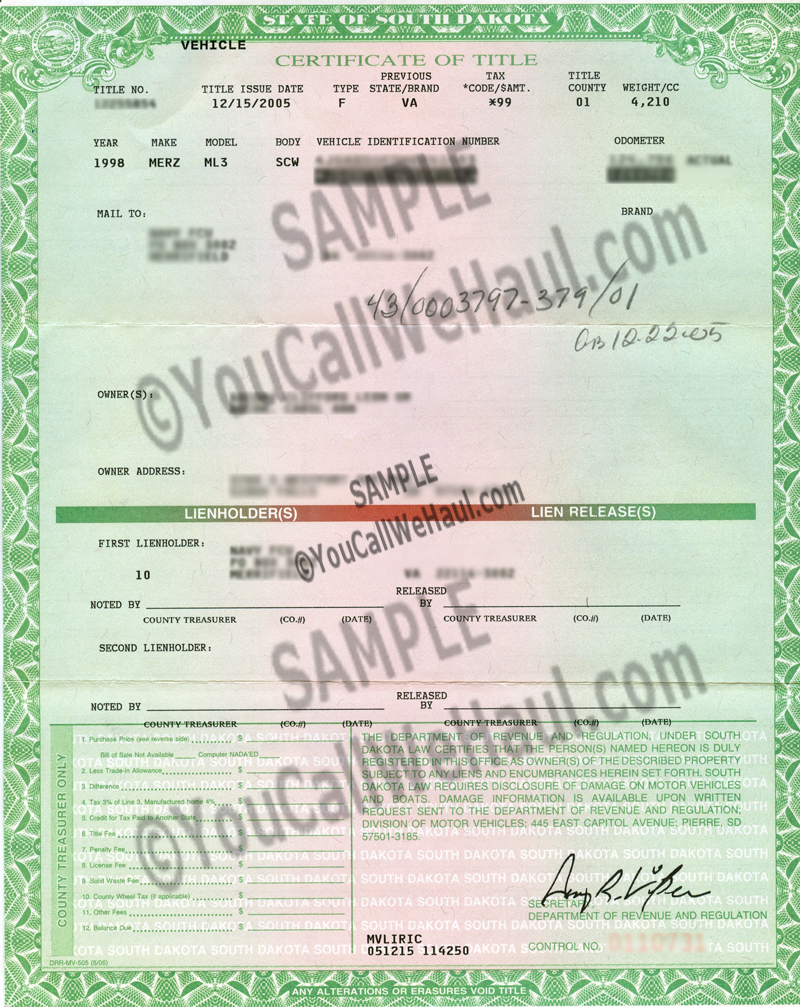

My Vehicle Title What Does A Car Title Look Like

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A

Cars Trucks Vans South Dakota Department Of Revenue

Bills Of Sale In South Dakota The Forms And Facts You Need

-%20Reverse.png)

South Dakota Vehicle Titles Kids Car Donations

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

South Dakota Sales Tax Small Business Guide Truic

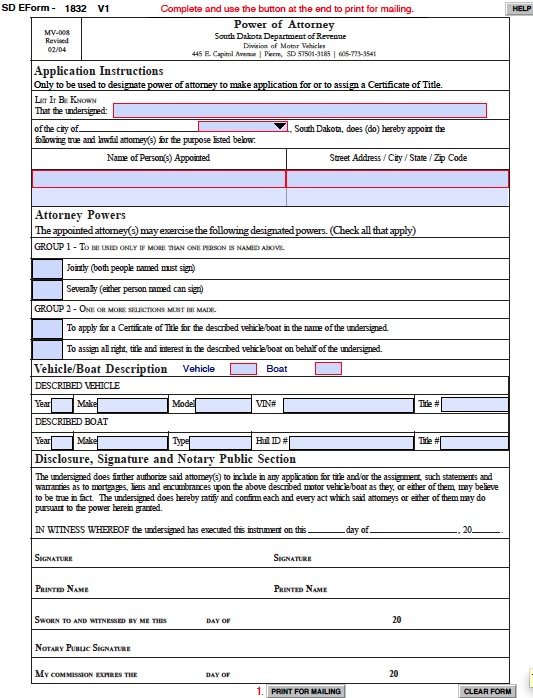

Free Division Of Motor Vehicles Power Of Attorney South Dakota Pdf

What S The Car Sales Tax In Each State Find The Best Car Price